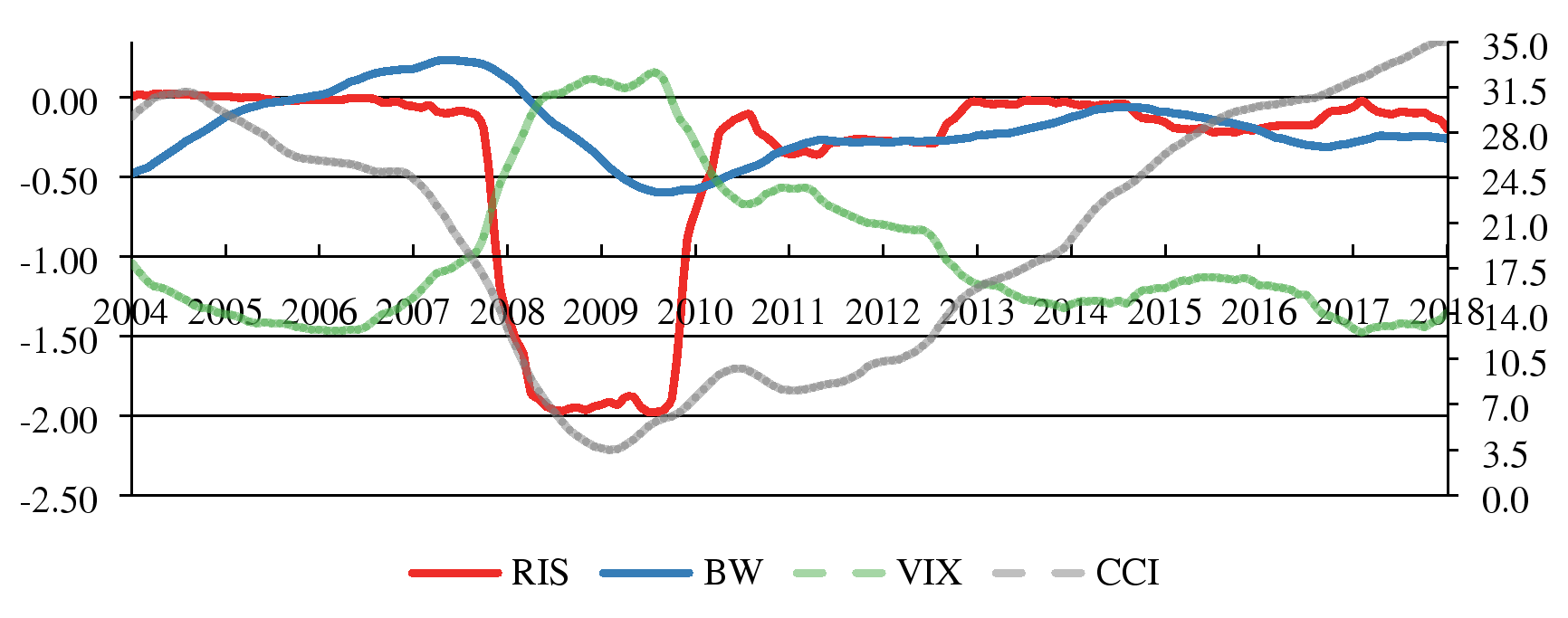

Monthly Sentiment Index for U.S. Equity Market

The paper “Relative Investor Sentiment Measurement[1]” develop a new approach to measure sentiment in financial markets. This approach quantifies the risk loading of informed and uninformed investors by two calculation procedures; thus distinguish the different trading activities of informed and uninformed investors. Based on this definition of sentiment, the paper constructs the monthly market sentiment index for U.S. equity market. The 24-month rolling average sentiment level is shown as below:

Note: RIS, BW and CCI are the new sentiment index, Baker-Wugler index and Consumer confidence index, respectively. To make the comparison clearer, VIX is presented in percentage terms with scales shown on the right axis.

The new sentiment index has several advantages: (1) it shows good return predictability for equity market; (2) the portfolio strategies based on the sentiment index have superior performance; and (3) it can be applied to measure firm-level sentiment.

撰稿:高翔,王展

摄影:高翔,王展

审核:李志刚

[1]The method is developed in the following working paper: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4122594